What Happens to Safety Deposit Boxes When a Bank Fails?

Safety deposit boxes have long been a trusted method for individuals and businesses to safeguard their most valuable possessions. Whether it's important documents, family heirlooms, or precious jewelry, many people rely on the security provided by these boxes located within banks.

However, the recent economic uncertainties have raised concerns about the fate of safety deposit boxes in the event of a bank failure.

Understanding the risks and legal protections associated with these boxes is crucial for those who want to ensure the safety of their valuables.

The Role of Banks in Safeguarding Valuables

Banks have traditionally played a vital role in safeguarding valuables for their customers.

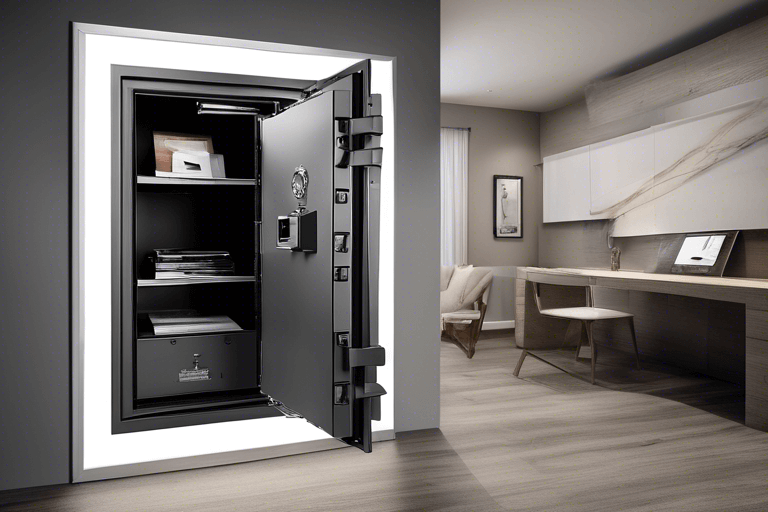

Safe deposit boxes are typically located within a bank's secure vault, offering protection against theft, fire, and other unforeseen disasters. This makes them an attractive option for those who value security and peace of mind.

Banks invest heavily in sophisticated security systems and protocols to ensure that these boxes remain secure. The level of protection provided by banks is one of the primary reasons why safety deposit boxes have been popular for decades.

Safety deposit boxes can also be installed homes, hotels, hospitals and other organizations.

Understanding the Risk of Bank Failures

While banks are generally considered to be stable institutions, there is always a risk of failure.

Economic downturns, mismanagement, or other unforeseen circumstances can lead to a bank's collapse.

When a bank fails, it can have serious implications for its customers, including those who rely on safety deposit boxes to protect their valuables.

Understanding the risk of bank failures is essential for individuals and businesses that rely on these boxes for their security needs.

What Happens to Safety Deposit Boxes During a Bank Failure?

During a bank failure, the fate of safety deposit boxes can vary depending on the circumstances and legal regulations in place.

In some cases, the bank may be taken over by another financial institution, and the safety deposit boxes may remain accessible to their owners with no interruption.

However, in more severe cases, such as a complete liquidation of the bank, there is a possibility that the boxes may be temporarily inaccessible or even seized by government authorities.

This is a significant potential disadvantage of using a deposit box at bank. It is essential to be aware of the potential risks involved and to take necessary precautions to safeguard your valuables.

Legal Protections for Safety Deposit Box Holders

To provide some level of protection for safety deposit box holders, many jurisdictions have specific laws and regulations in place.

These legal protections vary, but they generally aim to ensure that the contents of safety deposit boxes are not subject to seizure or loss during a bank failure.

However, it's important to note that these protections may not always be absolute and can vary depending on the specific circumstances and jurisdiction.

Steps to Take if Your Bank Fails

In the unfortunate event that your bank fails, there are several steps you can take to protect your valuables.

First and foremost, it is crucial to stay informed about the situation and any developments regarding the bank's status.

Contacting the bank's customer service or visiting their website can provide you with the most up-to-date information. If the bank is being acquired by another institution, they may provide instructions on how to access your safety deposit box.

It is also recommended to keep copies of all important documents related to your safety deposit box, including rental agreements and proof of ownership of the stored items. This documentation can be useful in case of any disputes or legal issues that may arise during the transition period.

Alternatives to Traditional Safety Deposit Boxes

For those concerned about the risks associated with safety deposit boxes in banks, there are alternative options available.

One such option is the use of private vaults or storage facilities that specialize in secure storage. These facilities often offer more advanced security measures than banks, including biometric access, video surveillance, and 24/7 monitoring. These facilities are also typically more accessible to you year-round.

Another alternative is the use of digital storage solutions, such as encrypted cloud storage or digital asset management platforms. These options allow you to store important documents and valuable assets digitally, providing an extra layer of security and accessibility.

And of course, a home safe is always an option. We understand that having a safe deposit box outside of your home premises can in itself be a benefit, but depending on what you plan to store, a home safe deposit box may be a better choice.

Tips for Securing Your Valuables Outside of a Bank

Whether you choose to rely on traditional safety deposit boxes or explore alternative options, there are several tips you can follow to enhance the security of your valuables.

Firstly, consider maintaining an inventory of your stored items, including photographs, descriptions, and estimated values. This inventory can be invaluable for insurance purposes and can help expedite any claims in case of loss or damage.

Secondly, ensure that your chosen storage solution has adequate insurance coverage to protect against unforeseen events.

If utilising a home safe solution, consider implementing additional security measures, such as using high-quality locks or installing a home security system.

Lastly, regularly review and update your security measures to adapt to changing circumstances and emerging technologies.

The Future of Safety Deposit Boxes

As technology continues to advance and the financial landscape evolves, the future of safety deposit boxes remains uncertain.

While these boxes have been a reliable option for safeguarding valuables for many years, the emergence of digital solutions and changing consumer preferences may impact their long-term viability.

It is likely that safety deposit boxes will continue to exist in some form, as they offer a tangible sense of security that cannot be replicated by purely digital solutions. However, we predict that they will become increasing less available at banking institutions.

Conclusion: Ensuring the Safety of Your Valuables

Safeguarding your valuables is a crucial responsibility, and understanding the fate of safety deposit boxes in bank failures is an important step towards ensuring their security.

While banks have traditionally provided a secure environment for these boxes, the risk of bank failures necessitates a proactive approach.

Familiarize yourself with the legal protections in place, explore alternative storage options, and implement additional security measures to protect your valuables effectively.

By taking these steps, you can minimize the potential risks and ensure the safety of your most treasured possessions.