Smart Strategies: How to Keep Money Safe at Home Without the Risk

Are you concerned about how to keep money safe at home amid threats like burglary and fire? This guide will equip you with straightforward, reliable measures to protect your cash.

From selecting the best safes to crafty concealment techniques, prepare to fortify your finances against the unexpected, all while maintaining the convenience of having your money within arm’s reach.

Key Takeaways

Invest in a good fireproof home safe, and consider integrating it with a smart home security system for the best protection of your cash at home.

Get creative with your emergency cash hideaways—think hollowed-out books or fake electrical outlets, and spread your cash out to minimize risk.

Balance accessibility with security for your cash at home and understand the importance of financial institutions for the protection of larger sums.

Choosing the Right Home Safe for Your Cash

Storing cash in your home is a serious affair. It’s not just about squirreling away your emergency fund in a cookie jar or under the mattress. A more secure solution is needed for your hard-earned savings.

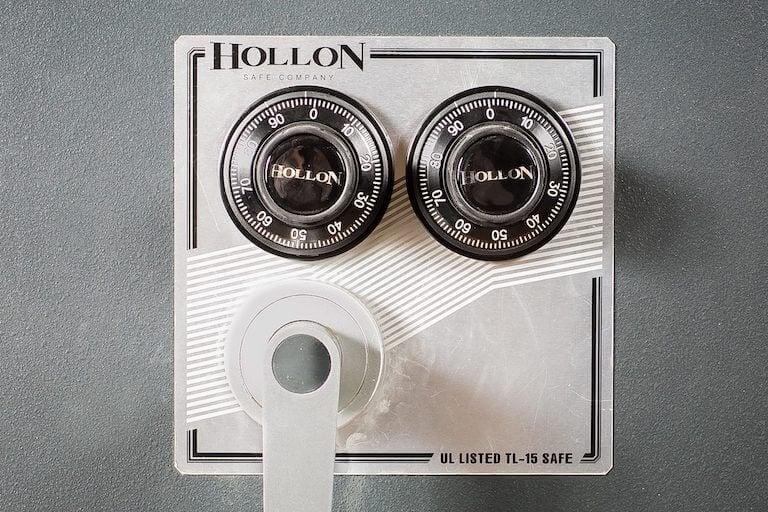

Ever heard of a home safe? These heavy-duty steel containers are optimal for cash storage at home. Better yet, opt for a fireproof home safe. Knowing the maximum temperatures and duration of protection your safe can withstand is of utmost importance.

Home safes come with a variety of lock options, including key locks, combination dials, electronic keypads and even biometric locks.

Biometric safes, for instance, can offer higher security than traditional safes because they don't require a key that can be lost or a combination that can be forgotten.

These safes integrate biometric fingerprint scanners that allow for quick access to the safe’s contents, be it cash, important documents or other valuables, making them a preferred option for many homeowners.

Prioritize Fireproof Features

Given how devastating a house fire can be, safeguarding your cash from such a disaster should be as much a consideration as protection from theft. A "fireproof" safe can withstand high temperatures of up to 1,700°F for an hour or more, effectively shielding your cash from damage during house fires.

However, when it comes to fire resistance, not all safes are created equal, and a safe’s level of fire protection may reduce as it ages, so it’s vital to track its rated duration and temperature limits and potentially replace it over time.

Biometric Locks for Quick Access

Biometric safes are gaining prominence in the security industry. Their high-security standards surpass those of key or combination safes, given that they are not easily accessible if the key is lost or the combination is forgotten.

Quick-access biometric safes often include silent mode features for discreet access, and illuminated keypads ensure rapid cash retrieval in low visibility conditions.

With the ability to store multiple fingerprints, quick access to your emergency fund is just a touch away for up to 50 family members or authorized users.

Bolstering Your Safe with a Home Alarm System

While a home safe alone is a good start, coupling it with a smart home security system elevates its protective capabilities.

This combination provides 24/7 continuous protection without requiring manual activation, which complements the security of a safe.

Plus, smart security systems are accessible and controllable via mobile devices, adding convenience to managing home security from anywhere.

Ingenious Hiding Spots for Emergency Cash

So, you’ve got your safe sorted out. But what if you need some emergency cash on hand that doesn’t require you to open a safe? Diversifying hiding spots for emergency cash within your home can provide an added layer of security. Here are some ideas for hiding spots:

Inside a hollowed-out book on your bookshelf

In a sealed envelope taped to the bottom of a drawer

Inside a fake electrical outlet

Buried in a potted plant

In a hidden compartment in your furniture

Splitting up cash into multiple hiding places reduces the risk of burglars finding all of it in the event of a break-in, just don't forget where you've hidden it!

Think creatively and venture beyond the typical sock drawer for your hideaways. The key to an ingenious hiding spot is to think outside the box, or rather, inside items you’d least expect.

For instance, old appliances or children’s toys can be repurposed as secret compartments to conceal cash.

If you’re a bookworm with a substantial home library, a hollowed-out book can turn into a brilliant indoor hidden storage space for your extra cash.

The Art of Concealment in Plain Sight

Hiding cash in plain sight might sound counterintuitive, but it’s an art in itself. The trick is to use everyday items as your secret vault, with cash hidden inside.

For instance, a tennis ball with a secret cut can serve as a simple yet ingenious place to hide cash, blending in perfectly with your sports gear.

Old media cases like DVD or CD cases can turn obsolete items into clever cash storage locations that blend in with a home’s usual clutter. Who would think to look there, right?

Securing Small Amounts for Immediate Needs

Although securing a substantial amount of cash is necessary, having a small amount readily available in secure locations for immediate needs is equally important.

So, how do you determine the best hiding spots for these small amounts? It’s all about observing areas of your home that are overlooked or not frequented by guests or other household members.

And remember to periodically check the hidden cash to ensure it hasn’t deteriorated or been damaged.

Balancing Security and Accessibility

Having explored the various methods of storing and hiding cash, it’s crucial to find a middle ground between security and accessibility when you decide to hide emergency cash.

After all, what’s the use of having an emergency fund if you can’t access it during an emergency? The key is to keep your cash secure yet accessible by authorized individuals.

However, accessibility doesn’t mean everyone should have access. Information about the locations where cash is stored at home should be restricted to essential family members to reduce the threat of theft and improve financial security.

Family Access vs. Security

While it’s essential to ensure that trusted family members know how to withdraw money and retrieve the funds in emergency situations, too much access can compromise security.

Secure yet accessible storage solutions, such as lockable drawers or cabinets, can provide family members with the necessary access to cash when required, without compromising overall security.

Preparing for Natural Disasters

Natural disasters are unpredictable, and in such scenarios, having a small amount of cash in easily accessible but secure locations within the home can be crucial for day-to-day expenses.

The Federal Emergency Management Agency (FEMA) suggests keeping some cash in your home for emergency situations and including safe deposit boxes in your emergency preparedness plans, for secure document storage during a natural disaster.

The Role of Financial Institutions in Protecting Your Money

Although keeping physical cash at home can be practical and at times, necessary, the protective role financial institutions play in safeguarding your money is equally important.

The risks of storing cash at home include the potential for theft, loss, and the impact of inflation reducing the value of physical currency over time.

Financial institutions, on the other hand, offer a higher level of protection against these risks. For instance, bank accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC), ensuring up to $250,000 of savings is protected in the event of bank failure or theft.

However, how much cash should you keep at home, and how much should you deposit in a bank? Let’s delve into that next.

When to Rely on Bank Accounts

While it’s convenient to have cash at hand for emergencies, relying on bank accounts for long-term storage is a safer option.

FDIC insurance ensures up to $250,000 of your savings is protected, and savings accounts also allow your money to earn interest over time.

Keeping cash at home for long-term storage is disadvantageous as it does not earn any interest, hence decreasing in value over time with inflation.

Deciding How Much Cash to Keep at Home

So, how much cash should you keep at home? Financial experts recommend maintaining an emergency fund with enough cash to cover at least 3 to 6 months’ worth of living expenses.

However, during situations such as recessions or periods of uncertain income, it may be wise to store an amount exceeding the standard emergency fund recommendation.

Protecting Your Cash from Environmental Risks

In addition to theft, environmental hazards like moisture and water damage pose a threat to your cash reserves and other valuables.

To counter these risks, store your cash in waterproof containers and use a dehumidifier if necessary.

Cash stored in areas prone to high humidity or flooding can deteriorate due to mold, rot, or tearing. Using a dehumidifier can prevent paper currency from becoming moldy and rotten over time, maintaining the integrity of the cash.

Regularly checking the moisture level within your safe or storage area is vital to confirm the dehumidifier’s effectiveness.

Keeping Cash Dry and Intact

In addition to controlling moisture, it’s important to keep your cash dry and intact. Waterproof containers are essential for keeping cash undamaged by water.

Watertight containers and freezer-safe zipper bags are effective places to store cash, in addition to being contained in a fireproof and water-resistant safe.

Maintaining Privacy When Storing Cash

When storing cash at home, exercising discretion in your storage methods is a key measure to mitigate the risk of home theft.

Discussing cash storage or the presence of large amounts of cash in the house can create a target for theft.

The Fewer People Know, the Better

While it’s natural to discuss financial matters with friends and family, talking about cash storage might inadvertently lead to information leaks that could compromise the safety of your cash.

Maintaining secrecy about the location of cash storage at home is crucial to minimize the risk of theft. However, while it’s important to maintain privacy, it’s equally crucial to ensure that trusted family members have access to the cash in times of emergencies.

In Summary: Be Smart with Your Cash

As we’ve explored, keeping your cash safe at home isn’t just about having a good hiding spot. From choosing a fireproof safe with biometric locks to diversifying your cash storage strategy, there’s a lot to consider.

But with careful planning and the right approach, you can ensure your hard-earned savings are secure and accessible when you need them.

In conclusion, it’s important to balance security with accessibility, invest in a high quality home safe, diversify your storage methods, and maintain privacy when storing cash at home.

Frequently Asked Questions

What is the safest way to keep cash at home?

The safest way to keep cash at home is to invest in a quality, fire-resistant safe. It's also a good idea to store cash in a sealed waterproof container to reduce deterioration.

How much cash can you keep at home legally in US?

You can legally keep as much cash as you want at home in the US, but the amount covered under a standard home insurance policy is usually limited to $200.

How much cash should I have on hand?

You should have at least $1,000 for emergencies, and it's recommended to aim for an amount that can cover three to six months of expenses.

Is it safe to store cash at home?

It's practical to have some cash at home for emergencies, but storing large amounts can pose risks. It's advisable to store most of your money in insured bank accounts and invest in a good safe for cash storage at home.

What kind of safe should I get for storing cash at home?

You should get a fireproof safe made from heavy-duty steel and consider one with a biometric lock for quick access and better security.